How to Measure ESG Performance

by Stacey BarrESG – or Environmental Social and Governance – performance measures abound, but which matter most to your ESG goals?

I’ve never been a fan of one-size-fits-all or off-the-shelf measurement. So I don’t believe measuring ESG is as simple as complying with a standard suite of ESG metrics or KPIs. Treating ESG measurement as a compliance activity robs its potential of helping organisations pursuse high performance.

“But our current focus on ESG measurement is dangerously narrow. It fails to capture the complex, systemic nature of social and environmental systems, and indeed that of business organizations themselves.” — Jennifer Howard-Grenville, in HBR

To make ESG measurement more meaningful, I think we need to start by systemically blending ESG into our organisation’s strategy. Then we can develop the ESG measures that align to what matters most to our organisation’s current journey to greater sustainability.

Blending ESG into our organisation’s strategy starts with understanding what our big-ticket ESG performance results are, in the context of our organisation’s purpose and current strategic direction. It’s not feasible – and it will quickly become trivial – if every organisation to measure every facet of ESG.

For example, when I collated the ESG performance areas recommended by just three ESG service providers, I ended up with a very long list of things to find ways to measure:

| Environmental | Social | Governance |

|---|---|---|

| Biodiversity

Carbon emissions Energy efficiency Environmental risks Land preservation Packaging Pollution Waste disposal Water consumption |

Community empowerment

Company culture Cyber security Data privacy Diversity & inclusion Equity Health & safety Human capital development Infrastructure investment Labour standards Product safety |

Anti-corruption

Board structure Economic reporting Ethical behaviour Incident management Management compensation Regulatory compliance Transparency and reporting |

The list is likely much longer, which we’d quickly discover if we spent more time finding other recommended aspects of ESG.

The thing is, each organisation will have a relatively unique combination of impacts on the environment, on their society, and on their governance. Just by way of example:

- A digital service organisation would have less of an impact on the environment, but certainly a high impact on society (e.g. data security).

- A park maintenance organisation would have a significant impact on the enviroment (e.g. biodiversity, water consumption and chemical use), a significant impact on society (e.g. health and safety, social connection), but maybe less of an impact on governance.

- A banking organisation might not have a significant impact on the environment, maybe a little impact on society (e.g. data privacy), but a big impact on governance (e.g. anti-corruption, economic reporting, ethical behaviour, and regulatory compliance).

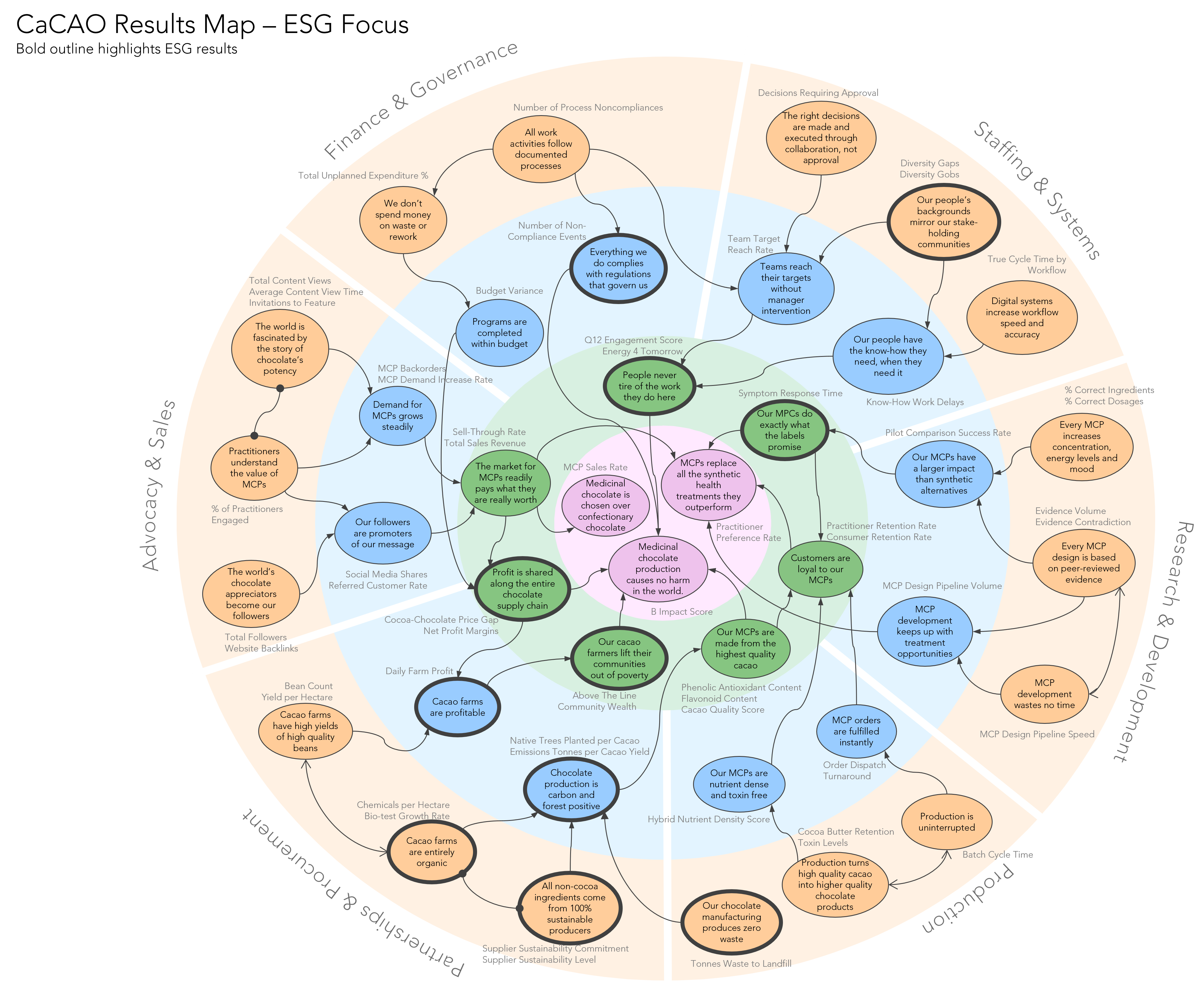

Some organisations will have significant impact on all three dimensions of ESG, but even still, they need to prioritise which impacts exactly matter most. For example, imagine an organisation that researches and manufactures medicial chocolate products: the Cacao and Chocolate Apothecary Organisation, or CaCAO. They would have impacts on all three dimensions of ESG, such as these:

- Environmental: biodiversity around cacao plantations, pollution from pesticides used on cacao plantations, and packaging of their medicinal chocolate products.

- Social: prices paid to cacao farmers, diversity in their team, and safety and efficacy of medicinal chocolate products.

- Governance: board structure representing stakeholders across the cacao supply chain, regulatory compliance with manufacturing, and transparency of profit across the cacao supply chain.

But that doesn’t mean CaCAO have to measure every aspect of environmental, social and governance performance, like the table above suggests. Rather, they’ll use their strategy design process to choose their priorities. In a PuMP Results Map, those priorities would show up like the results highlighted with the bolder borders, here (you’ll need to click to open a larger and easy to read version):

[click to open a larger and easy to read version]

There is no off-the-shelf set of ESG performance measures to bolt onto your performance reporting system. There are no short-cuts to getting the performance information that your unique organisation needs, to manage its unique impacts in the world. It will take deliberate thinking, prioritising your ESG results, and designing the measures that directly evidence those priority results.

If your organisation is stuck on finding the right ESG performance measures, make some constructive forward progress by following these steps:

- What are the 3 to 5 dimensions of ESG that are strategically important, right now, to your organisation? Don’t answer this with 5 minutes of brainstorming – have a strategic conversation about it, in the context of your existing corporate strategy.

- Articulate your priority ESG results in clear, measurable language. Avoid weasel words and overly broard concepts. And blend those ESG results into your organisation’s strategy map or Results Map.

- Design performance measures for those measurable ESG results. Start with the evidence you’d observe if they were being achieved, and then find feasible ways to quantify that evidence regularly over time.

You might have noticed that none of these ideas on how to measure ESG performance are unique to ESG. That’s because when we want to meaningfully measure anything that matters, the steps are the same. What gets us into trouble is not following those steps, or trying to do them too quickly. If ESG is more than just a tick-in-the-box activity to your organisation, then take the time to measure it meaningfully.

Please build on these ideas, by sharing your own ESG performance measure experiences in the comments on this blog post.

Connect with Stacey

Haven’t found what you’re looking for? Want more information? Fill out the form below and I’ll get in touch with you as soon as possible.

167 Eagle Street,

Brisbane Qld 4000,

Australia

ACN: 129953635

Director: Stacey Barr